Save Social Security by Making the Rich Pay Their Fair Share

Senator Dianne Feinstein

SF Office: (415) 393-0707

DC Office: (202) 224-3841

LA Office: (310) 914-7300

Fresno Office: (559) 485-7430

San Diego Office: (619) 231-9712

If you can't get through to one office, try another. There is no benefit to calling one office over another. Leaving a voicemail is as good as reaching a live person.

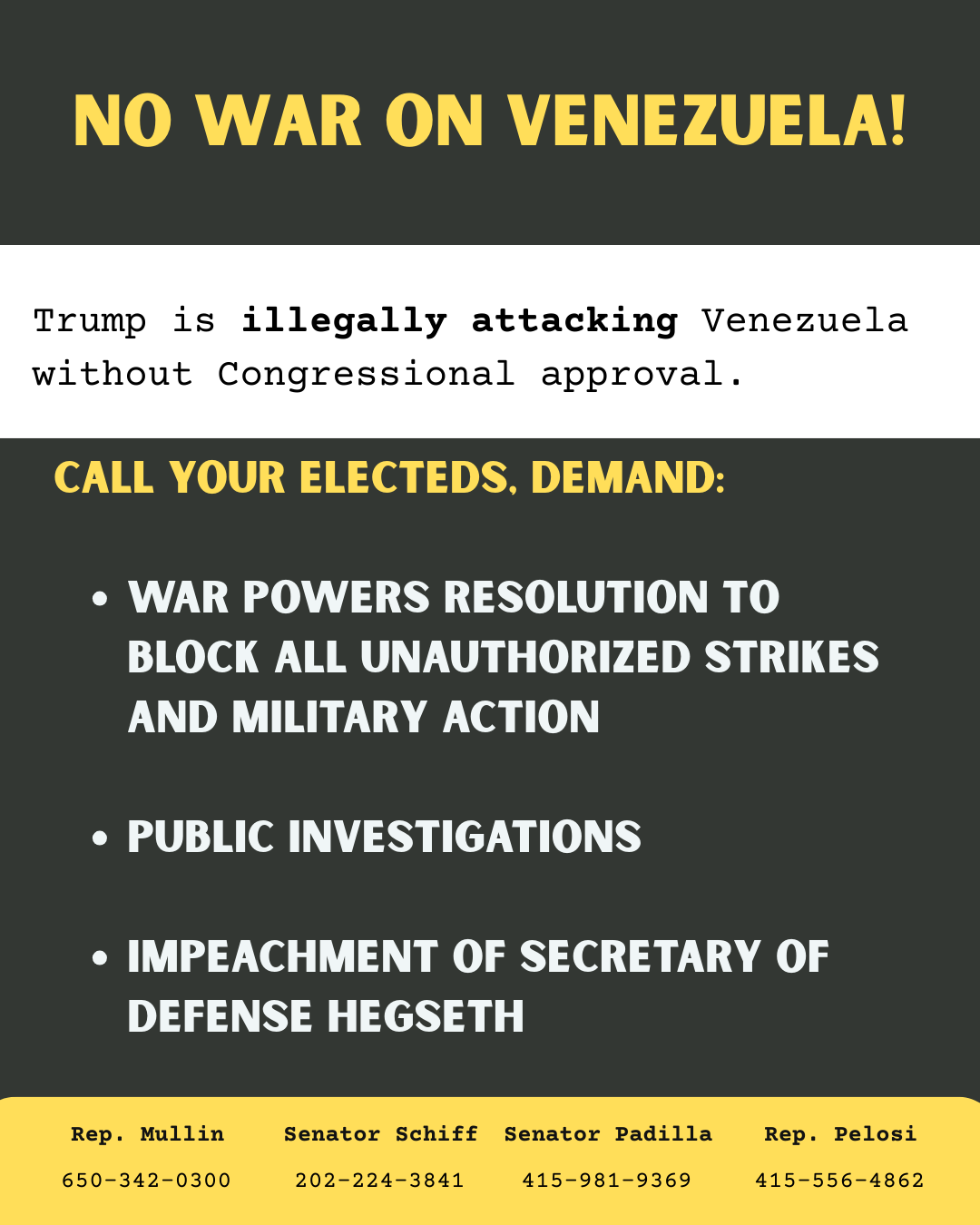

Senator Kamala Harris

SF Office: (415) 981-9369

DC Office: (202) 224-3553

Sacramento Office: (916) 448-2787

LA Office: (213) 894-5000

San Diego Office: (619) 239-3884

Call the SF office first, but try the other offices if you can’t get through. If you can’t get a live person, leave a voicemail and also send a follow-up email written in your own words.

Note: only one of the following two Congresswomen represents you. To find out which one, click here.

Speaker Nancy Pelosi

SF Office: (415) 556-4862

DC Office: (202) 225-4965

Call the SF office first, but try the DC office if you can’t get through. If you get voicemail, hang up and try a few more times to talk to a real person. Don’t give up! Short direct messages are most effective.

Rep. Jackie Speier

San Mateo Office: (650) 342-0300

DC Office: (202) 225-3531

Keep calling if you don’t get through. Voicemails are logged daily into a central report across offices.

Call Script

My name is __________. I am a constituent, and my zip code is _______. I am a member of Indivisible SF.

I want to thank [the Senator/Leader/Rep.] for supporting the Social Security 2100 Act which will increase benefits, give additional aid to the poorest seniors, and most important of all protect Social Security so that young workers paying into it today are guaranteed that it will be there for them when they retire.

It is long past time that the rich pay their fair share, so I strongly support the provision that applies Social Security taxes to salaries above $400,000 per year. However, rather than raising the current social security tax on wage-earners, which falls particularly hard on low-income and self-employed workers such as those in the “gig economy,” I urge you to expand the tax to include non-salary forms of income such as capital-gains, dividends, interest, and rents.

Context

Most Americans pay a 6% tax on their wages for Social Security. But not the rich who pay much less -- or nothing at all. If this is allowed to continue, Social Security will not be able to pay full benefits to the young and middle-aged workers of today when they retire in decades to come.

Background:

As it now stands, some time around 2034 Social Security will run out of money and will have to cut back benefits by 20%-25%. At present, wage earners and their employers each pay 6.2% of wages (plus a separate 1.45% each for Medicare). These taxes are deducted from paychecks (labeled FICA or sometimes SSI). Self-employed workers such as freelance contractors and “gig” workers like Uber drivers have to pay both halves of the taxes so their rates are doubled.

As it stands now, the rich do not pay their fair share of Social Security taxes. The tax is only levied on the first $132,900 of wages paid. That $132,900 amount is often referred to as “the cap.” For most of us, that means every dollar we earn gets taxed from January 1 through December 31. But if someone reaches the magic cap before year's end, the taxes stop, so someone who is paid $266,000 annually stops paying SS tax halfway through the year. A CEO who is paid more than $7 million only pays SS tax on the first week of salary – after that nothing! Worse, the really rich, the Investor Class, pay no SS taxes at all on their main sources of income: capital-gains, dividends, interest, and rents. And the CEOs who are showered with $30 million in stock options for moving jobs to slave-wage countries pay no SS tax at all on such income.

As currently proposed, the Social Security 2100 Act will:

Increase the average benefit by around 2%

Protect the poorest seniors by setting the minimum benefit at 25% above the poverty line.

More accurately adjust benefits to account for inflation and the costs that seniors face.

Cut income taxes levied on SS benefits paid to high-income seniors

Ensure that increases in SS benefits do not result in loss of CHIP or Medicaid eligibility.

Move towards making the rich pay their fair share by taxing salaries above $400,000 per year.

Gradually raise the SS tax from 6.2% to 7.4%

The good: Taxing salaries above $400,000 and raising the rate to 7.4% will ensure that Social Security remains fully funded through the rest of this century and beyond. By taxing high earners it breaks the taboo against taxing the rich. Setting the minimum benefit (which has not been raised since 1972) at 25% above the poverty line rather than a paltry fixed amount will immediately help the poorest seniors and prevent low-income seniors from falling behind in the future. The general increase in benefits and cost-of-living adjustments will more accurately reflect the economic challenges facing seniors, particularly rising medical expenses.

The not so good: Leaving the cap at $132,900 and then resuming taxes on salaries over $400,000 leaves a “doughnut hole” of untaxed salary income between those two amounts. Worse, the bill still leaves non-wage sources of income completely untaxed.

Conclusion: Despite its shortcomings, this is a great bill that we should strongly support while fighting to make it even better by eliminating the tax rate increase and expanding the tax to non-salary sources of income.

References

Fact Sheet: The Social Security 2100 Act, John Larson (D-CT)

Democrats Push Plan to Increase Social Security Benefits and Solvency, by Robert Pear. New York Times.

A Huge Step Forward In The Quest To Expand Social Security, Nancy Altman. Forbes Magazine.