Student Loans Relief Explainer

Check out our updated edition for 2023!

As of October 18, 2023, we’ve published a new 2023 edition of our student loans relief explainer that covers what’s changed since last year.

What follows is the old 2022 edition, for archival purposes.

The short version: What to do, and when to do it by

Apply for Public Service Loan Forgiveness by October 31, 2022. If you apply before that date, you may be eligible to apply even if you have already gotten a Teacher Service Loan.

Log into StudentAid.gov now to make sure your contact info is up-to-date.

Apply for one-time student debt relief of up to $20,000 now. You must apply by November 15 to ensure you get relief before payments resume on December 31.

Subscribe to updates on the Department of Education website to know when more loan relief is coming!

Resume making your student loan payments as of January 23, 2023. Starting on this date, you must pay your student loans, even if you believe they will be discharged by borrower defense. If they are discharged, your payments will be refunded.

Watch for future Department of Education rulings on proposals for removing interest capitalization and automatic cancellation of loans for predatory schools.

Payments resume January 23, 2023.

What relief is the Biden Administration providing?

The Biden Administration is reducing excessive student debt on multiple fronts, including:

A one-time cancellation of up to $10,000 or $20,000

Expanded eligibility for Public Service Loan Forgiveness, including the ability to count the same periods of work for both Teacher Loan Forgiveness and Public Service Loan Forgiveness (ordinarily, each period of work can only be counted toward one or the other)

A new income-driven repayment plan that won’t allow principal to increase as long as you make payments

Cancellation of loans for the costs of attending a fraudulent school (“borrower defense”)

One-time Student Debt Relief

$10,000 in debt cancellation for those who:

ARE NOT a Pell Grant Recipient

Have less than $125,000 in individual income OR less than $250,000 in household income

$20,000 in debt cancellation for those who:

ARE a Pell Grant Recipient

Have less than $125,000 in individual income OR less than $250,000 in household income

Application is available online now.

Apply before Nov. 15th to get relief before payments resume

Note: This program is temporarily on hold by court order. You should still apply, but relief may be delayed until courts allow the Administration to begin discharging debt until this program.

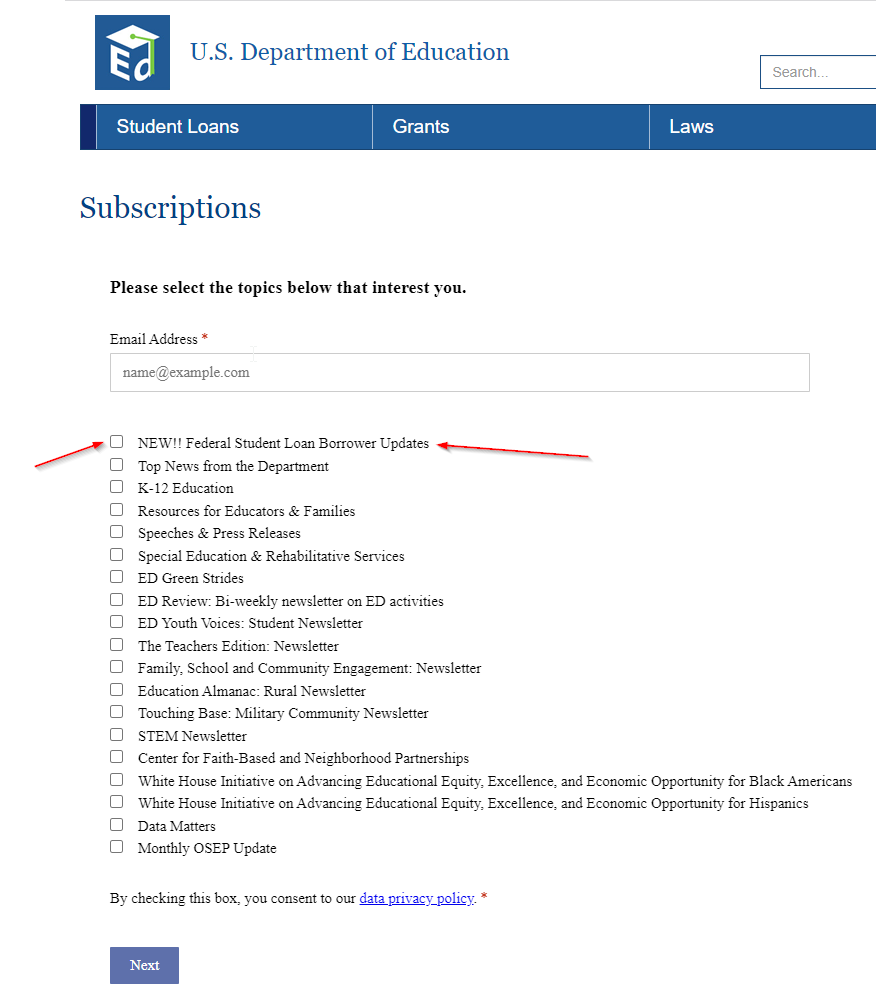

Subscribe to updates on the Federal Student Loan Borrower program to be notified of any changes.

Screen capture of the US Department of Ed website showing what to subscribe to.

Public Service Loan Forgiveness

If you have worked in federal, state, local, tribal government or a non-profit organization for 10 years or more (even if not consecutively) you may be eligible to have all your debt canceled. You should also apply for forgiveness if you have not yet served 10 years. Deadline to apply is October 31, 2022. Apply and more info here.

If you apply after October 31, the expanded criteria (the “Limited Waiver”) will have expired. Whether your eligibility for PSLF runs out then will depend on whether you fit into the normal PSLF criteria or only the Limited Waiver. The Student Aid website has a breakdown of which criteria apply under normal PSLF and how the Limited Waiver expands eligibility until October 31.

Teacher Loan Forgiveness

You may be eligible for up to $17,500 of forgiveness on direct subsidized and unsubsidized loans, and subsidized and unsubsidized Federal Stafford loans, as well as Consolidation loans.

Usually, you can’t get credit towards Teacher Loan Forgiveness and Public Service Loan Forgiveness for the same period of work. However, this has been waived until October 31 for people who already received Teacher Loan Forgiveness, so apply for the Public Service Loan Forgiveness by then! (This is the Limited Waiver we mentioned above.)

To apply for Teacher Loan Forgiveness, submit this form from the studentaid.gov website to your loan servicer. For more information, see the website.

If you have Perkins loans, you may also be eligible for Perkins Loan Teacher Cancellation.

You may also be eligible for Perkins loan cancellation as an early childhood education provider, veteran, nurse or other public servant.

Application for cancellation or discharge of a Perkins Loan must be made to the school that made the loan or to the school’s Perkins Loan servicer. The school or its servicer can provide forms and instructions specific to your type of cancellation or discharge.

Future changes to Income-Based Repayment

The Biden administration is proposing a rule to create a new income-driven repayment plan that will substantially reduce future monthly payments for lower- and middle-income borrowers.

The rule would:

Require borrowers to pay no more than 5% of their discretionary income monthly on undergraduate loans. This is down from the 10% available under the most recent income-driven repayment plan.

Raise the amount of income that is considered non-discretionary income and therefore is protected from repayment, guaranteeing that no borrower earning under 225% of the federal poverty level—about the annual equivalent of a $15 minimum wage for a single borrower—will have to make a monthly payment.

Forgive loan balances after 10 years of payments, instead of 20 years, for borrowers with loan balances of $12,000 or less.

Cover the borrower's unpaid monthly interest, so that unlike other existing income-driven repayment plans, no borrower's loan balance will grow as long as they make their monthly payments—even when that monthly payment is $0 because their income is low.

We have not found an official proposal on this yet, and we’re assuming it’s in progress. We will update the article when we have more information.

Borrower Defense

Apply for Borrower defense if you believe your school misled you.

Pursuant to the preliminary settlement on the Sweet vs. Cardona court case, you may be eligible in the coming months for automatic complete discharge of your loans and refund of your previous payments if you went to the following schools.

This settlement’s approval is preliminary - it still needs to go through at least one court hearing and we will know the final approval as soon as November, but possibly later. Once the settlement is final, you will be notified in 90 days as to whether your loan is canceled.

More information:

Settlement information from the Project on Predatory Student Lending.

Settlement information from the Department of Education.