Preserve Free Tax filing: Do the IRS Direct File Survey

Take a few minutes to complete the Direct File survey to support the non-commercial, apolitical civil service in carrying out an essential governmental function. The survey will be available through September 5.

Background

As part of its systematic campaign to subvert democracy, the MAGA regime proposes in its Project 2025 manifesto to privatize as many inherently governmental functions as possible. One of these functions is tax collection.

Many countries, including Australia, Canada, Mexico, and most in Europe, simply send out a pre-filled tax return that taxpayers can review, adjust, and sign, greatly simplifying taxpaying for most households. The US hasn’t even approached that level of government service. However, under the Biden administration, the Internal Revenue Service began piloting the Direct File program to allow some taxpayers to file their tax documents on-line at no cost, despite the objections of tax-preparation software companies such as H&R Block and Intuit (TurboTax). Now, the One Big budget bill includes funding to “replace any direct e-file programs run by the Internal Revenue Service”. The now-fired IRS Commissioner, Bill Long, said at a tax professionals conference in July that the IRS Direct File program was already “gone”.

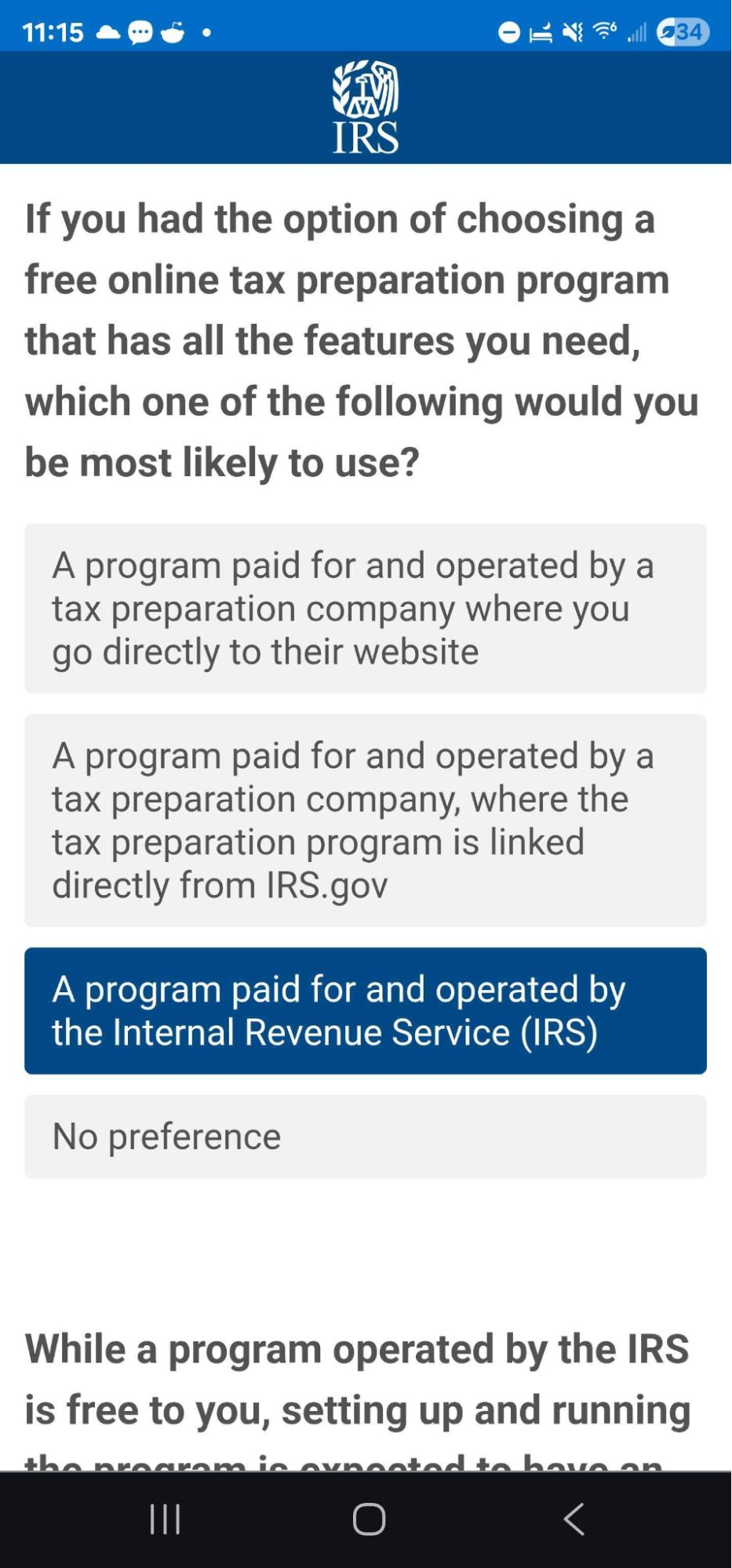

But the Administrative Procedures Act requires federal agencies to collect and evaluate comments from the public when they propose to change a regulation, including one that allows the IRS to provide free e-filing. So, in this case, the IRS is collecting input on the proposal to eliminate Direct File through an on-line survey. The survey’s scope is limited, excluding many issues around tax collection and providing no opportunity to submit comments, and it contains leading questions about the provider:

and the cost of the program:

Even if survey results show that the public supports government-provided free filing, the administration may or may not choose to implement the public’s preference. But here are two reasons for us to weigh in.

Silence means assent. If we have a preference, we have to stand up and say so. Public comment can also provide the basis for a legal challenge to a proposed rule change.

When a large number of voters register their position on a regulatory change, members of Congress can use that information to influence the regulatory change or even block it by passing a Congressional Review Act resolution. And we can use that information to encourage our MoCs to act.

This will be even more applicable if the IRS implements a formal comment period on this proposal.